Equity release allows you to use some of the money tied up in the value of your home to get a tax-free lump sum. This money can then be spent on anything you choose, and many across the UK use it to renovate, to put towards retirement or even to leave to their families.

However, releasing equity on your home can only be done by those over the age of 55 in the UK who own their own homes, and this process can often seem daunting. Today we’re putting together our top ten tips for those considering getting an equity release, and some questions to ask yourself, should you be thinking about it…

For more information on exactly what equity release is and what it entails, check out our Equity Release service page.

Question: Do you need an equity release?

1. Consider all of your options

Before seriously considering releasing equity on your home (which is a significant financial decision, and is not the right choice for everyone), make sure you’re claiming all the state benefits you are eligible for. As well as this, try to explore the possibility of other options to do with your property ownership, such as downsizing or renting out a room.

2. Do your sums

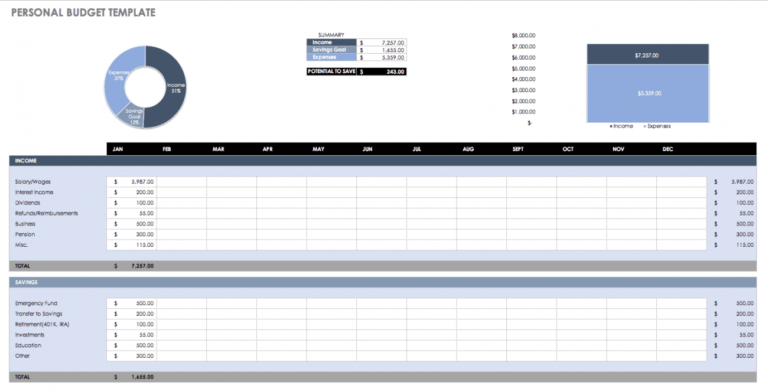

Before doing anything else, as with any other aspect of financial planning, it’s best practice to fill out a budget planner. Work out what your income requirements are and how these might change in the future and assess whether it’s necessary for you to carry out the equity release. There are plenty of free resources online to help you do this, such as this one from SmartSheet.com:

3. Check with your lender

If you’re considering an equity release to pay off a mortgage, speak with your existing mortgage lender or financial adviser. Professionals such as our experts here at Greenfields will be able to discuss every option with you and find the right way to go.

4. Weigh up spending on home improvements

If you’re looking to use the equity from your home to make home improvements, check first if your local authority offers any grants for this kind of work. This way, you may not have to take out equity on your home to afford this goal.

Question: Is it the right solution for you?

5. Talk to your family

Discussing your plans and options with your family or those closest to you will allow you to hear other opinions, and they may be able to help in other ways, or support your decisions.

6. Do your homework

There are many resources available online that are unbiased and educational that may help you learn more about equity release and how it works, as well as other financial products. Websites like the Money Advice Service are a great place to start, but for now feel free to check out our blog post on common myths about equity release.

7. Get expert advice

As we said above, do your own research, but also remember that policies can change and you can’t believe everything you read online. Make sure you speak with a qualified financial adviser if you’re seriously considering this. Make sure your adviser is also a member of the Equity Release Council. This organisations makes sure that all members abide by the overarching principles of the Council, and are educated on all aspects of equity release.

8. Get legal advice

It’s important that you receive independent legal advice from an experienced solicitor who can advise you and provide you with the necessary guidance that’s relevant to your specific situation. This is especially important, as is seeing a financial adviser, as equity release is a specialist area that can be both confusing and daunting to tackle alone.

Question: What’s the best equity release plan for you?

9. Understand different types of equity release

A financial adviser will be able to help you understand the difference between different types of equity release plans, such as home reversion plans and lifetime mortgages, as well as identifying any other solutions available to you.

10. Find out what will work best for you

Different products will have different features and facets, some of which will be a better fit for you than others. For example, some lifetime mortgages allow you to make monthly payments to avoid interest building up.

Overall, carrying out equity release has helped many people across the UK and made a positive difference to their lives. However, it is also a major financial decision, and should not be taken lightly. This is why we’ve put together this blog post to help clear up what we recommend before you carry it out.

For more information on equity release and how it may be able to help you achieve your personal goals, and to book your free initial meeting with one of our experts, visit our Contact page.