Since there is something of a winter chill in the air, and children across the area are wishing for some magical white precipitation, I wanted to write about the impressive power of compounding using snowballs as an analogy.

In sport or fitness we all want to lift more weight, run the same distance in a quicker time, or perhaps cycle further than before. This all takes times to build up, one cannot simply roll out of bed and run a half-marathon! We have to use some sort of progressive training plan, whereby we see small incremental improvements.

Our snowballs are either gathering momentum and growing larger, or they are melting away into a puddle. Yet we can also accumulate compounding snowballs in the wrong direction – think of a growing debt pile accruing interest against us, or the hedge in your garden growing larger and larger untrimmed.

If you are in your 20s or 30s and are thinking about your financial future then the decisions you take today will have the largest impact on your ultimate ‘retirement pot’. You may well be reading the news and hearing about an expected stock market crash. Or perhaps a trusted, well-educated relative or family friend has installed in you the belief that investing in stock markets is akin to ‘gambling’ and a sure fire way to lose money. We are all scarred by such stories from our younger years.

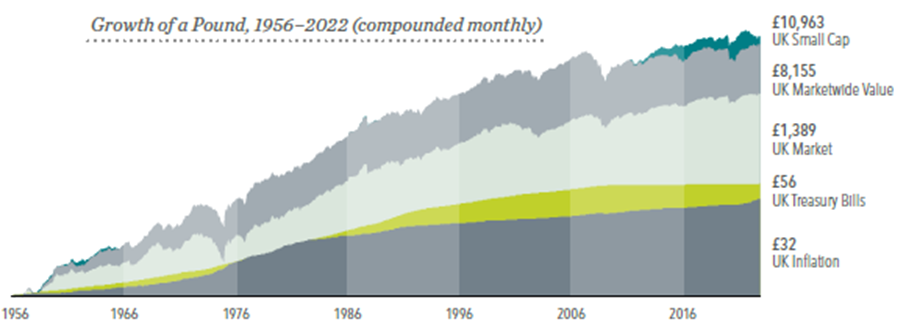

When starting out, you likely have atleast 3 decades until your retirement phase starts. Incidentally, that same retirement is hopefully going to last for a further 3 decades: 6+ Decades in total as in investment timeframe. Whilst we all love the notion of buying low, selling high, the wisest investors out there do little to nothing. Take a look at the following table showing the power of allowing your snowball to roll up and work for you. Do note that the table is not to scale – if it were, it would be going through your roof right now.

Source: Dimensional Fund Advisors – Pursuing a Better Investment Experience

Now granted, you are unlikely to see much movement in the early years, but returns compound upon each other and really do gather momentum. The moral being, the earlier you start, the greater your chances of future financial freedom. Please ensure that your snowballs are rolling in the direction you need them to roll – aligned with your goals and objectives in life.

If you are starting out on your financial journey, whilst you may not have sufficient capital for me to be able to take you on as a client, please, please do reach out. I’d love to have a complimentary chat to help you set your snowball rolling in the right direction.

Equally if you are nearing your retirement phase and need a review of your snowballs, I’d love to see if I can help you.